Article

SBA - Paycheck Protection Program Guidance

DISCLAIMER: Given the changing PPP guidance, this information may no longer be applicable.

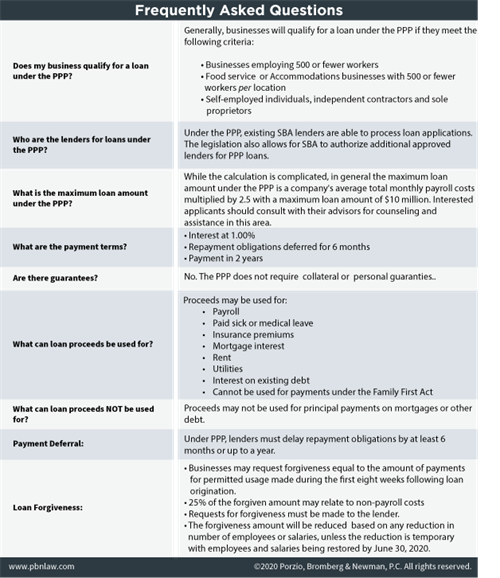

The Small Business Administration (SBA) has published guidance for the $349 billion Paycheck Protection Program (PPP) contained in The CARES Act. The PPP is designed to help small and mid-sized businesses offset the economic impact of the COVID-19 pandemic.

Beginning April 3, 2020, small businesses, including nonprofits and sole proprietorships, can apply for and receive loans to cover their payroll and certain other expenses through existing SBA lenders.

Starting April 10, 2020, independent contractors and self-employed individuals can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders. Demand for the forgivable low-interest loans is expected to be high, and funding is limited, so applying early will be critical.

The Paycheck Protection Program incentivizes small business employment through June 30, 2020 by providing loans to fund payroll and certain essential expenses, and forgiving some (or all) repayment based upon continued employment levels and actual payment of essential expenses.

What businesses need to know:

- Applications will be accepted starting April 3, 2020 for small businesses and sole proprietorships.

- Applications will be accepted starting April 10, 2020 for independent contractors and self-employed individuals.

- Applications must be completed by June 30, 2020.

- Prompt action is critical due to limited funding and the length of time for lenders to process applications.

Helpful Links: